Navigating Business Risks with Bagley Risk Management

Navigating Business Risks with Bagley Risk Management

Blog Article

Exactly How Animals Danger Defense (LRP) Insurance Coverage Can Safeguard Your Animals Investment

Animals Threat Protection (LRP) insurance stands as a reputable guard versus the unpredictable nature of the market, providing a calculated technique to guarding your assets. By delving into the intricacies of LRP insurance policy and its multifaceted advantages, animals manufacturers can fortify their financial investments with a layer of safety that transcends market variations.

Comprehending Animals Danger Defense (LRP) Insurance Coverage

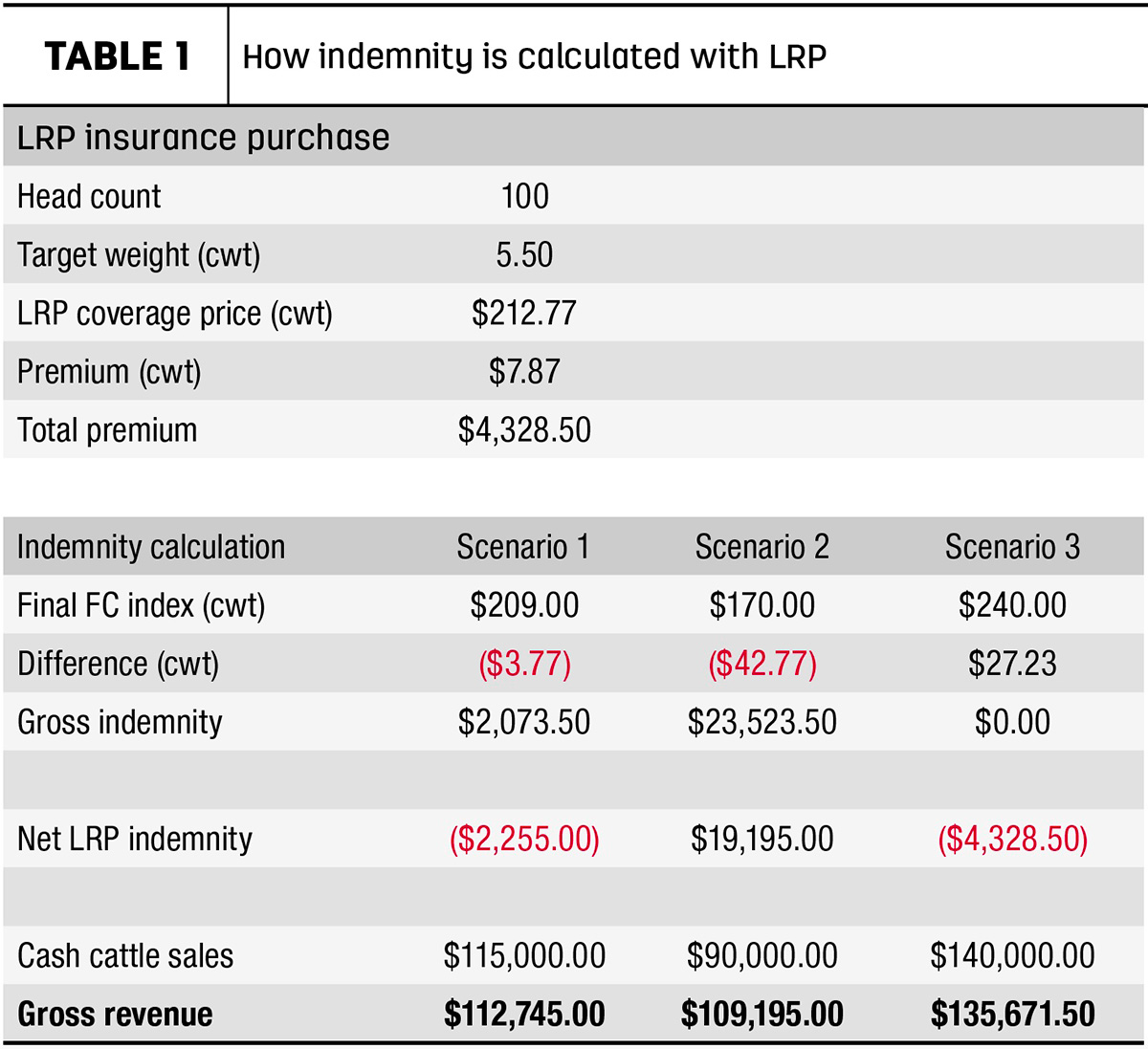

Recognizing Animals Danger Protection (LRP) Insurance is important for livestock manufacturers wanting to alleviate economic threats connected with price variations. LRP is a federally subsidized insurance coverage item developed to shield producers versus a decrease in market prices. By offering insurance coverage for market cost declines, LRP helps manufacturers lock in a floor price for their livestock, making certain a minimum level of earnings no matter of market variations.

One trick aspect of LRP is its flexibility, enabling manufacturers to customize insurance coverage degrees and plan lengths to fit their certain requirements. Manufacturers can choose the variety of head, weight variety, coverage price, and coverage duration that line up with their manufacturing goals and risk resistance. Understanding these personalized options is vital for producers to successfully manage their cost risk exposure.

Moreover, LRP is readily available for various livestock kinds, consisting of cattle, swine, and lamb, making it a flexible threat management tool for animals manufacturers throughout different fields. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make enlightened decisions to secure their investments and guarantee financial stability when faced with market uncertainties

Advantages of LRP Insurance Coverage for Livestock Producers

Animals producers leveraging Animals Risk Defense (LRP) Insurance acquire a strategic advantage in protecting their financial investments from rate volatility and safeguarding a steady financial footing among market uncertainties. By setting a flooring on the price of their animals, manufacturers can minimize the risk of significant economic losses in the event of market downturns.

In Addition, LRP Insurance supplies manufacturers with assurance. Recognizing that their investments are safeguarded against unanticipated market adjustments allows manufacturers to concentrate on other facets of their service, such as boosting pet wellness and well-being or maximizing manufacturing procedures. This comfort can cause boosted productivity and earnings over time, as producers can operate with even more self-confidence and stability. Overall, the advantages of LRP Insurance policy for livestock manufacturers are significant, providing an important tool for managing danger and guaranteeing economic safety and security in an unforeseeable market environment.

Just How LRP Insurance Mitigates Market Risks

Reducing market threats, Livestock Threat Protection (LRP) Insurance coverage supplies animals manufacturers with a reputable guard against cost volatility and monetary unpredictabilities. By supplying protection versus unanticipated rate declines, LRP Insurance coverage helps manufacturers protect their financial investments and preserve monetary navigate to this site stability despite market variations. This browse around here kind of insurance allows livestock manufacturers to lock in a rate for their pets at the beginning of the plan period, ensuring a minimal rate level no matter market changes.

Actions to Secure Your Livestock Financial Investment With LRP

In the world of agricultural risk management, applying Livestock Danger Security (LRP) Insurance includes a strategic procedure to guard investments against market fluctuations and uncertainties. To safeguard your animals financial investment properly with LRP, the initial step is to examine the particular threats your operation encounters, such as rate volatility or unanticipated weather condition occasions. Recognizing these dangers enables you to establish the protection level required to protect your investment properly. Next, it is essential to research and select a trusted insurance coverage copyright that uses LRP policies customized to your livestock and organization requirements. As soon as you have chosen a service provider, very carefully assess the plan terms, problems, and coverage limitations to guarantee they Check This Out align with your threat administration goals. In addition, on a regular basis keeping an eye on market trends and readjusting your protection as required can help enhance your protection against potential losses. By following these steps carefully, you can boost the safety and security of your animals financial investment and browse market uncertainties with confidence.

Long-Term Financial Safety And Security With LRP Insurance Coverage

Making certain withstanding financial stability through the use of Livestock Risk Security (LRP) Insurance policy is a prudent long-term technique for farming manufacturers. By incorporating LRP Insurance coverage into their risk administration strategies, farmers can guard their animals investments against unexpected market variations and damaging events that might jeopardize their monetary well-being in time.

One key benefit of LRP Insurance policy for long-lasting monetary safety and security is the satisfaction it offers. With a reliable insurance coverage in position, farmers can mitigate the financial dangers linked with volatile market problems and unforeseen losses because of variables such as disease outbreaks or all-natural catastrophes - Bagley Risk Management. This security allows producers to focus on the day-to-day procedures of their animals business without consistent stress over prospective monetary setbacks

Additionally, LRP Insurance provides a structured approach to managing danger over the long-term. By establishing details insurance coverage levels and choosing appropriate endorsement periods, farmers can customize their insurance policy plans to straighten with their monetary objectives and run the risk of resistance, making certain a sustainable and safe future for their animals operations. Finally, buying LRP Insurance coverage is an aggressive technique for farming manufacturers to achieve long-term economic security and secure their incomes.

Verdict

In verdict, Livestock Danger Protection (LRP) Insurance coverage is an important device for livestock manufacturers to mitigate market dangers and secure their investments. It is a wise selection for protecting livestock financial investments.

Report this page